A snapshot of RCEP

RCEP is a Free Trade Agreement ( FTA) between China, Japan, South Korea, Australia, New Zealand and the 10 ASEAN member states of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. When RCEP enters into force it will be the world’s largest FTA when measured by combined GDP (26 trillion dollars), population (2.27billion) and total export value (5.2 trillion dollars) of signatory parties.

RCEP includes 20 chapters in total, covering commitments in areas such as trade in goods, trade in services, investments, intellectual property, e-commerce, competition, government procurement and dispute settlement. The trade in goods chapter will likely be most important to most businesses, or at least most immediately impactful.

RCEP was signed in November 2020 and we expect it to enter into force either late 2021 or early 2022.

How can and should businesses respond to RCEP?

It is important to understand that the Asia Pacific is already flooded with multiple FTAs. Aside from RCEP being the first trade agreement linking China, Japan and South Korea, the remaining RCEP members already have multiple trade agreements with one another that can be used today. RCEP does not replace any of the existing FTAs available. Instead, it adds an additional dimension to regional economic collaboration.

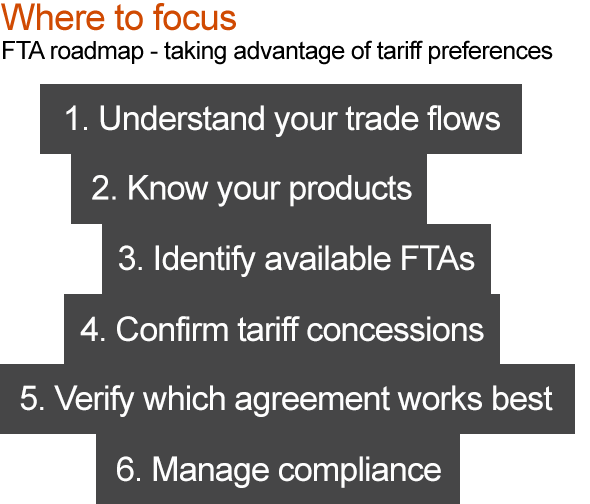

If you are looking to understand what specific benefits RCEP will offer, you need to perform an impact assessment. For this, there are no secret shortcuts that will quickly tell you what RCEP means to your company. You need to dive into the details of the agreement and evaluate it based on your current (and/or future) operations, product flows and objectives.

In-depth discussion: FTA roadmap

Understanding your trade flows

In order to take advantage of tariff preferences under an FTA, there needs to be an FTA in place between the country where you are manufacturing your product and where the product is going. Therefore, the starting point for any FTA assessment is to understand the physical flows of your product.

Know your product

In the world of customs, knowing your products means getting your tariff classification codes correct. These tariff codes are the single key determinant of the applicable duty rates and FTA qualifying rules for your products. Working off the basis of inaccurate tariff codes will result in compliance gaps that will likely result in a loss of FTA privilege and other compliance issues. Disagreements between authorities on appropriate tariff classification is another very common reason why FTA use fails. A strong rationale, and perhaps some classification rulings, would be a wise idea.

Identity available FTAs

Navigating the noodle bowl of FTAs in Asia Pacific is not easy. RCEP will add a regional FTA to an already impressive list of FTAs available. It is important to understand and identify all FTAs that are applicable to your trade flows in order to optimise your FTA strategy. For example, between Singapore and Japan there are at least 4 FTAs that can be used once RCEP enters into force.

Confirm tariff concessions

Once you know your products (i.e. have the correct tariff classification codes) and know all the possible FTA options, you need to identify the FTA tariff rate that applies. Each FTA has its own tariff reduction schedule and if you have multiple products you need to confirm them individually. This can take time and be challenging to navigate. For example, if you manufacture products in Vietnam and export them to Japan, you may find the most preferential rate under the ASEAN-Japan EPA for one product. For another product it may be the Japan-Vietnam EPA or the CPTPP. This can also change over time depending on an FTAs reduction schedule or when RCEP enters into force.

Verify which agreement works best

This is the most challenging step as there can be many reasons why the “best” tariff rate may not apply to your product. For example:

- You may not meet the origin qualifying rule specific to the FTA and specific to your product. This rule can vary, often subtly, by agreement.

- You may do your final stage processing in the wrong country, or your final stage process makes you “lose” origin.

- You may not be able to “cumulate” the value of materials of subcomponents or materials if they come from the wrong place or come without the required documents.

- You may not be able to meet the supply chain rules specific to the FTA. Provisions on direct shipment, invoice flows, the format of certificates of origin etc. are just some considerations that you will need to assess based on your company’s supply chain.

- You cannot get the required paperwork.

All, and more, of the above considerations may determine that your products only qualify under a particular agreement. This should feed into your supply chain decisions on where to source, where to process, and where to sell. And those considerations need to be reviewed real-time, or at least at regular intervals.

Manage compliance

Making sure that you take full advantage of FTA benefits is not easy. It takes effort, resources and a significant amount of time if you want to get it right. But at the end of the day it is important to understand that FTA use is not a right, it is a privilege that potentially offers your company a great advantage and should therefore be treated accordingly. It is also treated by the authorities as a privilege, hence any shortcuts can have serious consequences.

If you want to make the most of FTAs you should make sure there are clearly defined responsibilities within your organisation. Who is ultimately responsible, who performs the analyses, who manages compliance, who makes sure FTA preferences are always claimed when they are available, etc. These are questions that are of increasing importance to every company. The allocation of those responsibilities should be clear if you are looking to optimise your company’s FTA use. Based on our experience, having buy-in from senior management to make sure FTA management is considered when important business or supply chain decisions are made is crucial.

PwC observations

Before entering fully into force, the RCEP will require a ratification process to be completed by all member countries. The agreement will only take effect after at least six ASEAN member states and three non-ASEAN member states have completed ratification. This can sometimes be a relatively quick process but can also take years in some countries. We expect the agreement to enter into force for most members either in the second half of 2021 or in early 2022.

Compared to other modern regional agreements such as the CPTPP and the ASEAN Trade In Goods Agreement, RCEP has less coverage in terms of depth of many commitments and offers a slower reduction of tariffs. RCEP is also a relatively complex agreement with certain countries having different tariff reduction schedules for different countries of origin within RCEP. The mix of positive and negative lists for trade in services is another example of complexity. It will be important for companies to navigate these differences across the agreement when assessing impact.

Nevertheless, the RCEP will likely have an important impact on the Asia-Pacific region. It will enhance economic integration, promote free trade and facilitate economic growth. Through the formation of stronger value chains across the region, RCEP will also encourage companies to shift focus towards Asia and to intra-regional trade. Historically many Asian exporters have had their focus firmly on the big and rich consumer markets in North America and Europe, but that may well chance, especially as growth is more likely to come in Asian markets.

RCEP will also be the first FTA that Japan has with China and with Korea. This makes RCEP an important agreement for all three countries. For all members, there are many pre-existing FTAs which means there are several trade agreements currently available for companies that can be used today and may already give the benefits offered by RCEP. This should be taken into consideration when assessing the impact of RCEP to ensure the most beneficial agreement is being used.

What you can do to prepare

While RCEP is expected to only enter into force in a year or so, companies doing business in Asia Pacific should perform an impact assessment to determine the benefits available. When doing so, the benefits that other FTAs already offer should be reconsidered, as they may have changed since they were last looked at. Comparing benefits already available under existing FTAs to the benefits RCEP may add will allow companies to develop an optimal overall FTA strategy.

Once the RCEP enters into force, origin compliance management and proactive application of preferential tariff treatment should be prioritised to optimise RCEP benefits. Implementation details on additional tariff reductions, customs procedures, inspections, quarantine measures and other technical standards should be actively monitored to further reduce the costs and enhance efficiencies in the supply chain. Some aspects of implementation are left to the discretion of member states, and it may be in a company’s interest to lobby for a particular type of implementation.

Impact on supply chain planning

The US-China trade war and the COVID-19 pandemic are recent and current challenges that have forced many companies in Asia-Pacific to start thinking about long term supply chain planning. Building a more resilient business model and being prepared to respond to disruption are key priorities for many companies today and will likely become more important going forward. The signing of RCEP can have an important role to play in this respect. The signing in itself will have an immediate impact by sending a positive message on how the leading economies in the Asia-Pacific are looking towards free trade and maintaining multilateral trading systems as the solution to promote economic growth and recovery. Not only will this help the region to build a stronger foundation to encourage greater regional collaboration, but also to shift focus towards Asia form elsewhere when important supply chain decisions are being made.

In addition, the RCEP may ease some of the pressure companies feel to diversify their manufacturing footprint. With better market access possible through existing facilities, more drastic changes to physical supply chains may be put on hold for a little while.